Editor’s View: About buns, cream and GST

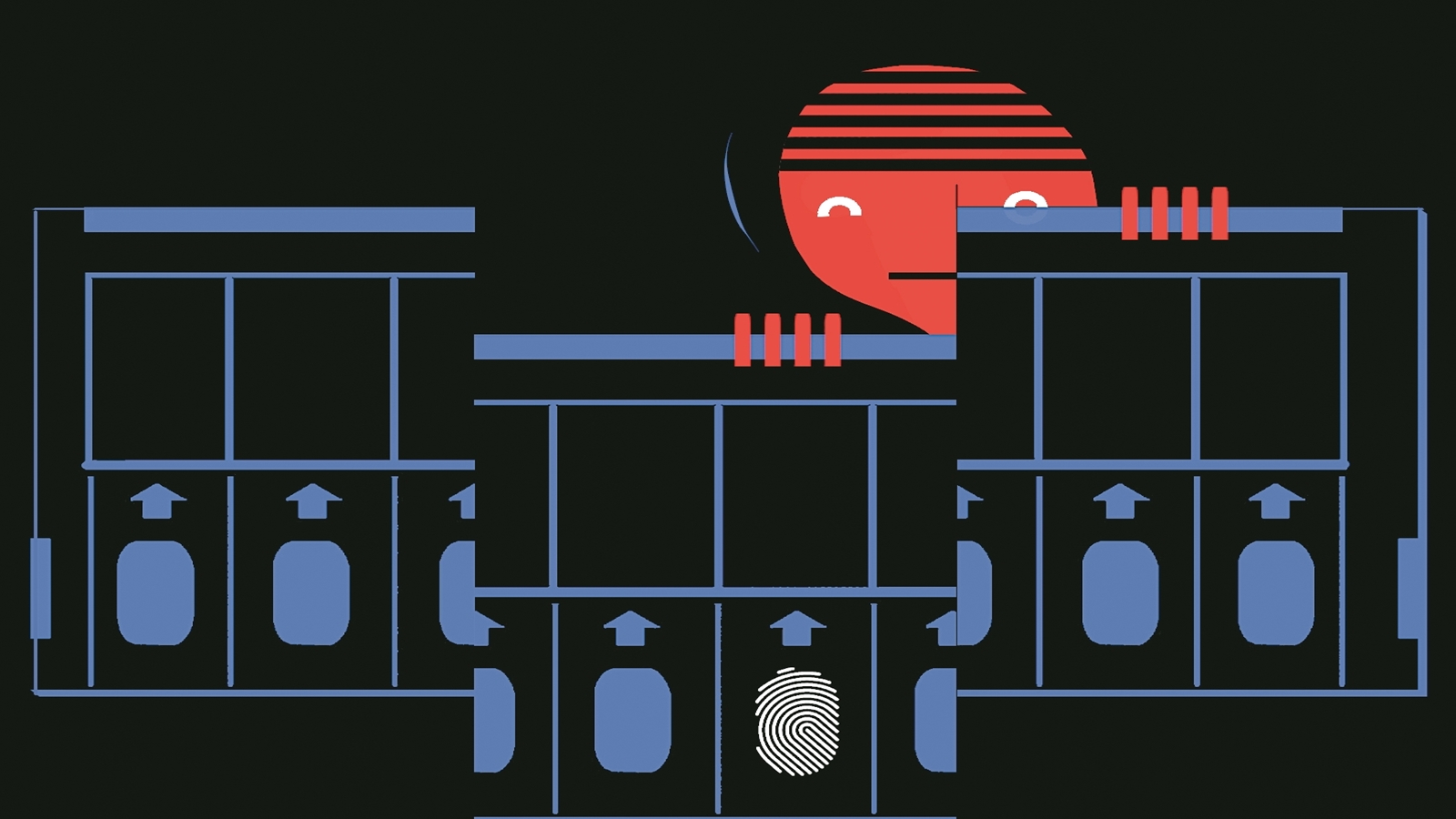

Tax disparities confronted via companies because of the multi-rate construction underneath the GST regime proceed to be a sore factor.

In a gathering with Finance Minister Nirmala Sitharaman a couple of days in the past, D Srinivasan, managing director of Annapurna Lodges in Coimbatore, additionally identified some peculiarities of the present oblique tax gadget in regards to the adaptation in charges levied on buns and cream buns. “Shoppers now say they would like the bun and cream one at a time in order that they may be able to follow the cream themselves to economize,” he reportedly mentioned. (‘GST row round finance minister, eating place chain forces Tamil Nadu BJP to retract its commentary’, Indian Categorical, September 14)

Then again, this isn’t the one odd instance. Actually, there were many such instances earlier than. As an example, pizza offered and ate up in eating places can be taxed at a charge of five %, whilst pizza delivered at house can be taxed at 18 %. Any other factor was once whether or not Nestle’s KitKat was once a chocolate or a biscuit. The editorial on this paper (‘Rationalise charges’, IE, August 24) It had additionally identified some peculiarities of the present tax regime. “In a similar fashion, there is not any common sense in now not levying GST on milk, however skimmed milk powder is being taxed at 5 in step with cent and butter and ghee at 12 in step with cent,” it mentioned. It added that levying a 12 in step with cent tax on milk fats could also be an anomaly “whilst vegetable fats (suitable for eating oil) is taxed at 5 in step with cent.”

The imposition of 18 in step with cent GST on clinical and lifestyles insurance coverage has additionally been broadly criticised. Actually, Union Minister Nitin Gadkari had previous mentioned that levying 18 in step with cent GST on insurance coverage is corresponding to taxing the “uncertainties of lifestyles”. (‘Gadkari urges finance minister to roll again 18% GST on lifestyles, health insurance premiums’, Indian Categorical, August 1)

Within the discussions that preceded the exchange within the GST construction, many had advocated in favour of choosing a unmarried charge tax gadget, somewhat than the multi-rate construction that was once ultimately agreed upon. For example, the thirteenth Finance Fee, headed via Vijay Kelkar, had urged a unmarried charge of 12 in step with cent (5 in step with cent for Central GST and seven in step with cent for State GST).

The more than one charge construction will increase the compliance burden, particularly for small and medium enterprises. It ends up in problems about classification of products as has been proven in lots of circumstances and will increase the potential for rent-seeking. For companies, this now not simplest drains away precious assets that can have been deployed extra successfully somewhere else, but additionally will increase the potential for litigation.

The executive financial adviser’s record on income impartial charge had advisable a three-rate construction – a decrease charge on items, a regular charge on items and products and services and a better/deregular charge on items. Then again, it argued in favour of a shift to a single-rate construction within the medium time period. The present GST construction has 5 primary charge slabs: 0, 5, 12, 18 and 28 in step with cent. And there could also be the levy of repayment cess.

Given the complexities led to via the more than one charge construction, many have argued in favour of decreasing the tax slabs. Whilst the GST Council has referred the problem to a gaggle of ministers, there seems to be some hesitancy against rationalising the velocity construction. No longer shifting forward in this factor would now not be a prudent possibility. As this paper’s editorial argues, “The velocity rationalisation workout will have to pass forward, focusing now not simplest on decreasing the collection of tax slabs – one proposal is to merge the 12 and 18 in step with cent slabs – but additionally reviewing the pieces in every slab to handle grievance about asymmetries within the gadget,” (‘Ease of paying taxes’, Indian Categorical, 9-11)

In contrast to India, maximum nations all over the world have in fact opted for a far more practical tax gadget. In step with the International Financial institution’s India Construction Replace 2018, 49 of the 115 nations surveyed via the financial institution had opted to impose a unmarried tax charge, whilst 28 had followed a two-rate construction. Handiest 5 nations – Italy, Luxembourg, Pakistan, Ghana and India – have 4 or extra slabs.

The GST tax base has expanded ceaselessly through the years. By means of June 2024, the entire collection of taxpayers was once 1.4 crore, with 42.5 lakh having migrated from the pre-GST regime. Collections underneath this oblique tax regime are set to extend from Rs 11.77 lakh crore in 2018-19 to Rs 20.18 lakh crore in 2023-24. In conjunction with this, the GST Council has additionally taken a number of steps to stop leakage from the gadget. The Council will have to now transfer ahead at the debatable factor of rationalizing the charges.

Supply hyperlink

#Editors #View #buns #cream #GST