The Very best Enlargement Shares to Purchase Now at $200

In case you are in search of enlargement shares that will help you acquire wealth for retirement, it isn’t sufficient to select the inventory of any rising corporate that is ceaselessly hitting new heights. There are different necessary qualities you will have to search for, too.

Clearly, you wish to have an organization that has superb enlargement possibilities, however it is also really helpful to spend money on a industry that has a devoted base of shoppers who ceaselessly spend cash with the corporate. This provides the industry flexibility, particularly right through recessions and downturns.

One corporate that instantly involves thoughts is Amazon (NASDAQ: AMZN)There are 3 causes for this.

1. Producing ordinary earnings from thousands and thousands of shoppers

Amazon has thousands and thousands of retail consumers who ceaselessly use their Top club to reserve more than one pieces each and every month. Statista estimates the collection of Top contributors at 167 million within the U.S., and greater than 200 million international, with an estimated 42% of U.S. Top contributors making two to 4 purchases each and every month. That is a large reason Amazon has grown into a large industry with trailing 12-month earnings of $604 billion as of June 30, 2024.

During the last 4 quarters, Amazon earned $42 billion from subscriptions and $237 billion from its on-line retailer. The corporate continues to extend its same-day supply and grocery supply for Top contributors, reflecting its skill to extend acquire frequency and to find extra tactics to develop earnings.

Amazon additionally generates constant earnings from its undertaking cloud products and services. Amazon Internet Services and products (AWS) is the highest cloud computing supplier on the earth, with thousands and thousands of shoppers in over 190 international locations. AWS contributes lower than 20% of Amazon’s overall earnings, however importantly, it’s the maximum successful industry, contributing just about two-thirds of the corporate’s running benefit.

2. Amazon has super enlargement alternatives

There is a massive marketplace for Amazon’s on-line retailer and cloud industry, by which the corporate may develop for many years.

Consistent with eMarketer, the worldwide e-commerce marketplace is ready to succeed in $6 trillion this 12 months. Additionally it is anticipated to succeed in $8 trillion by means of 2028, so Amazon must make the most of the rising marketplace.

As for AWS, the chance for shareholders is much more horny. Income from AWS grew 19% 12 months over 12 months closing quarter, achieving $98 billion in earnings over the trailing three hundred and sixty five days. Alternatively, it’s estimated that a minimum of 80% of undertaking knowledge is but emigrate from on-premises servers to the cloud.

With such a lot alternative, AWS may at some point develop into an enormous industry — in all probability Amazon’s largest earnings supply. Upper margins from cloud products and services will considerably building up Amazon’s profitability and in addition spice up its stocks.

3. This inventory has massive upside attainable

Amazon at all times seems pricey on a price-to-earnings foundation. That is as a result of control does not set up the industry to maximise revenue consistent with proportion, however relatively to maximise long-term money drift from operations.

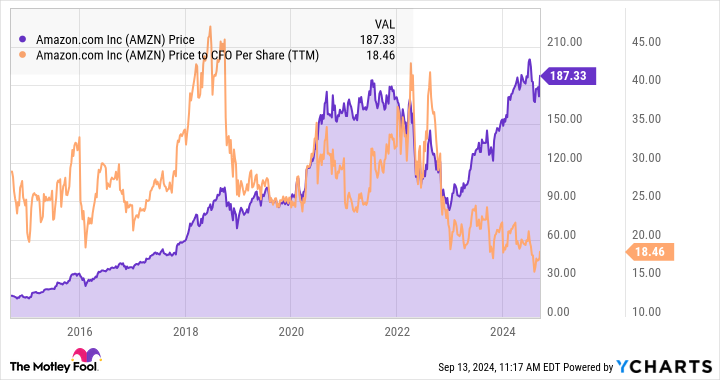

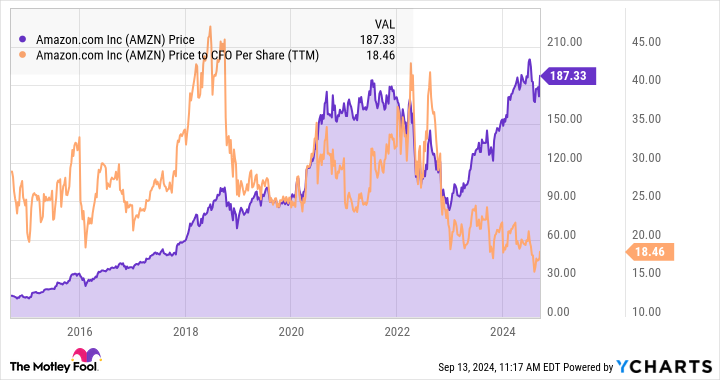

The use of Amazon’s money from operations (CFO) consistent with proportion, the inventory trades at a price-to-CFO more than one of 18.4. Regardless of the inventory’s payment doubling during the last 5 years, it’s buying and selling on the lowest P/CFO valuation in 10 years.

Amazon’s money from operations has tripled during the last 5 years to $107 billion. Have a look at the chart to peer how the inventory’s worth has risen following the corporate’s upward thrust in money from operations, however stocks proceed to industry inside the similar vary on a P/CFO foundation. With the alternatives that Amazon has in e-commerce and cloud products and services, its money from operations will keep growing through the years, and that suggests extra new highs for the inventory payment.

The inventory is recently buying and selling moderately under its contemporary top of $201, so for an investor with only some hundred greenbacks to spare, this is usually a nice alternative to shop for it.

Must you make investments $1,000 in Amazon at this time?

Imagine this sooner than purchasing stocks in Amazon:

Motley Idiot Inventory Consultant The analyst crew has simply recognized that they imagine 10 Very best Shares There are a couple of must-buys for buyers at this time… and Amazon wasn’t one in every of them. The ten shares picked may ship outrageous returns within the future years.

Imagine when nvidia This checklist was once created on April 15, 2005… In the event you had invested $1,000 on the time of our advice, You would have $729,857,

Inventory Consultant Supplies buyers with an easy-to-understand blueprint for luck, together with steering for construction a portfolio, common updates from analysts, and two new inventory choices each and every month. Inventory Consultant The provider is greater than 4 occasions S&P 500 Returns Since 2002*.

View the ten shares »

*Inventory Consultant returns as of Sep 9, 2024

John Mackey, former CEO of Amazon subsidiary Complete Meals Marketplace, is a member of The Motley Idiot’s board of administrators. John Ballard has no place in any shares discussed. The Motley Idiot has positions in and recommends Amazon. The Motley Idiot has a disclosure coverage.

The Final Enlargement Inventory to Purchase Proper Now with $200 was once initially revealed by means of The Motley Idiot

Supply hyperlink

#Enlargement #Shares #Purchase